We chat with ECI's summer intern, Enayeth Hussain, about how he discovered our internship through upReach, his advice for future applicants, and the most surprising thing he has learned about private equity.

Q: How did you first come across ECI’s internship partner, upReach?

upReach is all about helping students from less advantaged backgrounds access career opportunities they might not otherwise get, whether that’s through mentoring, skills development or even supporting you with basic things, like getting clothes for interviews.

Coming from Camden, a lot of people I knew were already part of it, so I saw how much it had helped others, and I wanted to be part of that too. Through the programme, I had a mentor in real estate private equity and now this internship. That kind of access is just incredible when you're a student. You get to speak with people in the industry, learn from them, and start to build your network. It really helps bridge the gap.

Q: What was the application process and interview with ECI like?

When I saw ECI on the upReach internship list, I knew that I had to apply, getting any kind of experience in private equity as a student is incredibly rare, and I could see ECI had an amazing track record. The submission was about why I wanted to work there, the skills I’d bring, and examples of teamwork or innovation.

The interview itself was actually a really good experience. It felt more like a conversation. I was asked about my interests and my studies – it wasn’t about catching me out or testing technical knowledge. I prepped in case, as I’ve had a few interviews where they say “no technical questions” and then ask for a full DCF breakdown, but I got the sense early on that ECI was genuinely interested in hearing from me and supporting my learning. That meant a lot.

Q: What advice would you give to other applicants in the future?

Do your research properly. I’d say understand what private equity is, but more importantly, understand where ECI sits within that. Learn what mid-market PE means, what kind of companies ECI invests in, and really get a feel for the portfolio. Private equity is about finding and growing great businesses, so if you can talk about a few of them, explain what they do, and why they interest you, that’ll really set you apart.

Q: What kind of projects have you been involved in since joining?

One that really stood out was a project to write up an initial investment memo for a company. I went through the company’s background, growth, SWOT analysis – it felt like something I would do working here. But, what was really great was I was then asked to join the team meeting and share my perspective, and it surprised me how much they valued my opinion. And that happened in my second week! Due to the younger end customer, I was able to show some different sources for reviews such as Reddit as I knew they wouldn’t be leaving them on TrustPilot. It felt like I was contributing, not just observing.

Q: Has anything surprised you about private equity?

Definitely how much of it is relationship-driven. I always assumed PE was more number crunching, but what I’ve seen is that relationships matter just as much, if not more.

There are conversations happening now with businesses ECI might invest in years down the line. That long-term thinking and trust-building really stuck with me. It’s also confirmed that I want to work in PE in the future. There’s space to be entrepreneurial, to build something, and to get results in your own way. I love that balance between analytical thinking and relationship management.

Q: What are you looking to do next?

I graduate this month, and two weeks after finishing at ECI, I’ll start a full-time role as a European Capital Markets Real Estate Analyst. It’s a bit like investment banking but for property. My time at ECI will be immensely valuable in framing thinking, but also it will be a great stepping stone to move into Real Estate Private Equity if I want to change in the future.

Quick Fire with Enayeth:

What did you want to do when you were five?

A striker for Arsenal until a kid in Year 6 joined who played for QPR’s academy made me realise that the dream might already be over...

What do you do to unwind?

I’m a big fan of “bed rotting”, which is just lying in bed on my phone. It’s my favourite hobby, I’m not even joking.

What’s your song for the summer?

RS6 by Dystinct ft. Morad

If you had to go on a TV show, what would you choose?

EastEnders. Everyone there makes terrible decisions, and I think I could help them out.

Do you have any hidden talents?

I play kabaddi, which is a South Asian sport that’s a mix of rugby and tag. I was captain and president of my university team, and I am part of the England set up, although we don’t really exist at the moment since we haven’t been invited to any tournaments. So maybe not that hidden… but definitely a big part of who I am.

Insights

28/07/2025

“Quick Fire” with Enayeth Hussain

With the summer holidays in full swing, it's the perfect time to dive into a good book, whether you're poolside, on a plane, or enjoying a quiet moment in the garden. From thought-provoking non-fiction to brilliant storytelling, here’s what the ECI team are reading this summer:

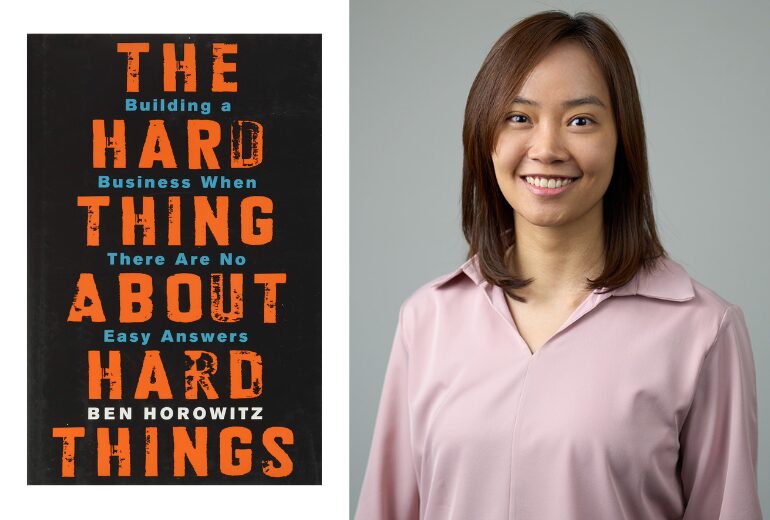

Jin Ni Ooi

The Hard Thing about Hard Things

I picked up The Hard Thing about Hard Things after a colleague at ECI recommended it, and it quickly became one of the most insightful business reads I’ve come across. Ben Horowitz doesn’t shy away from the realities of running a company. Instead, he dives into the gritty, unpredictable side of leadership that rarely get talked about. I found his honesty refreshing, especially when it comes to making tough decisions and dealing with failure. There’s a great section on managing through chaos that’s stuck with me – practical, direct, and weirdly reassuring.

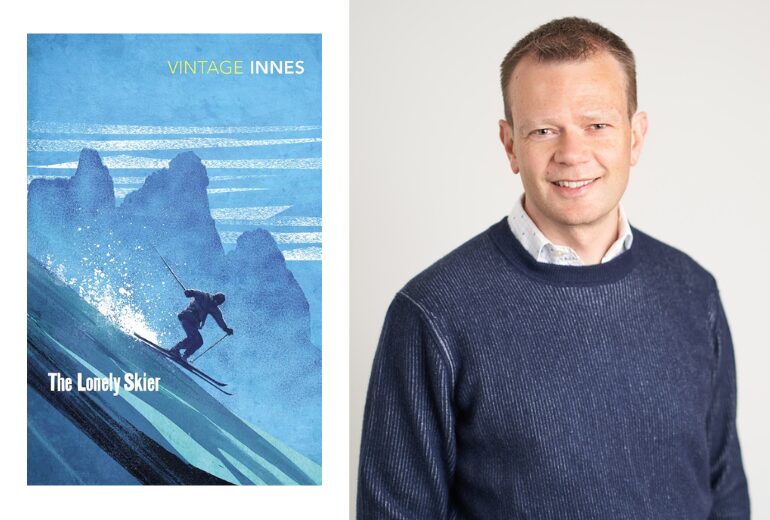

Chris Watt

The Lonely Skier by Hammond Innes

This was a thank-you gift from a friend for organising a ski trip, and it turned out to be quite a gem. The Lonely Skier is a 1940s thriller set in the Dolomites just after the war, where a down-on-his-luck ex-soldier is sent to a remote resort to pose as a screenwriter - only to get caught up in a hunt for hidden Nazi gold.

At well under 200 pages, it’s ideal if you’re busy or just need something pacey and instantly absorbing to clear your head. The setting is tense and atmospheric, the characters are boldly drawn and very much of their time, and the whole thing moves at a real clip. Hammond Innes - himself a former artillery officer - was known for his well-researched novels and his knack for creating memorable characters and compelling plots.

Not exactly business reading, but a great escapist holiday pick if you’re after something short, sharp, and gripping.

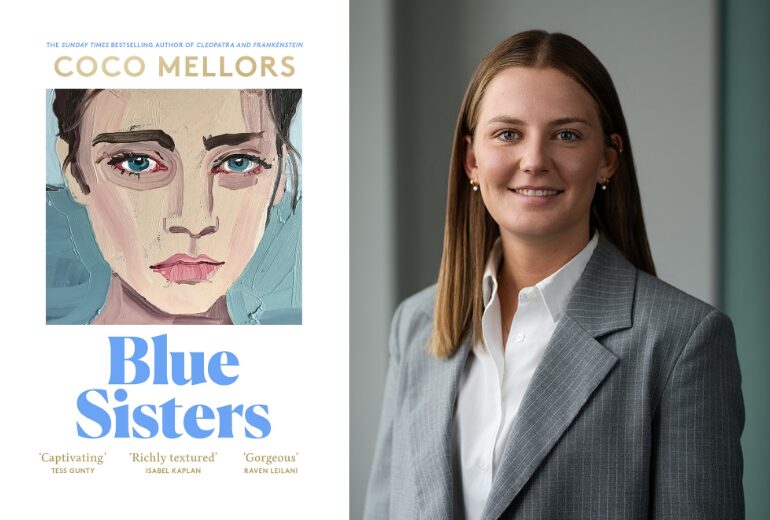

Simona Everts

Blue Sisters by Coco Mellors

I think having sisters made Blue Sisters by Coco Mellors especially engaging for me. The book follows three sisters reuniting after the death of their fourth sister, and its real strength is how it captures the complexity of sibling relationships. Whilst some parts felt a little far-fetched, I think that’s what makes it a great holiday read. It also tackles serious themes like addiction and depression in a way that’s both readable and emotionally honest.

Rich Pearce

The Wide Wide Sea by Hampton Sides

The Wide Wide Sea tells the story of Captain Cook’s third and final voyage. Not just the big discoveries, but also the growing tensions and mistakes that led to his death in Hawaii. He's a character who everyone has heard of and his legacy is increasingly debated and controversial, but someone I didn't know much about. It's told through the eyes of his crew and the people he met from their diaries, letters, and verbal histories. This approach makes it very real. You’re taken right into the action, from freezing seas to tropical islands, and you see how the journey affected both the crew and the people they met. It’s a fascinating and very human story, and well worth a read

Olivia McGee

The Thursday Murder Club

I found The Thursday Murder Club by Richard Osman to be an enjoyable and uplifting read. I loved the dynamic between the main characters, especially with it being told from Joyce’s perspective. Her voice is refreshingly light and engaging – it gave the narrative a unique charm.

What surprised me most was how hopeful the book made me feel about ageing, as it presents life in a retirement village as full of possibility, connection, and even adventure. While the murder mystery itself is cleverly constructed, it is the characters who truly bring the story to life. With a film adaptation coming to screens soon, and more books in the series, I’m looking forward to seeing how the story continues to unfold, both on the page and on screen!

Insights

24/07/2025

Read Time: Min

What are ECI reading? Our summer reading list

We're delighted to launch our first fundraising event in partnership with our charity partner, the Wilderness Foundation UK: ECI Sleep Out in the Woods.

On 7th August, a group of eight ECI team members will be swapping their beds for sleeping bags and spending the night in the Foundation’s 92-acre woodland. They will be completely alone, without technology, and surrounded only by the natural world. Each person will camp in their own secluded spot, embracing solitude, reflection, and a deep reconnection with nature - all to raise vital funds for the Wilderness Foundation and the life-changing work they do.

The Wilderness Foundation is a fantastic charity focussed on protecting wild spaces and transforming lives through nature-based therapy and education. Their programmes support vulnerable young people and adults struggling with personal or mental health challenges, helping them build resilience, confidence and a deeper connection to the world around them.

We’re proud to support their mission, and if you’d like to support the team and this brilliant cause, you can donate here.

News

17/07/2025

Read Time: Min

ECI launch first fundraising initiative with Wilderness Foundation

With ECI's IT Director and Growth Specialist for Cyber commemorating his 25th year at ECI, we wanted to celebrate the work he does both at ECI and across our portfolio. We asked members of the ECI team what Ash Patel brings to ECI and the transformation he has led internally.

News

17/07/2025

Ash Patel celebrates 25 years at ECI

We’re delighted to share that ECI Partners has been shortlisted in the PE House of the Year: Upper Mid-Cap category at the 2025 Real Deals Sustainable Investment Awards.

The Real Deals awards are among the most respected in the industry, celebrating excellence in ESG and sustainable investment practices across private equity. With an exceptionally strong field of entries this year, we’re proud to be recognised for our continued focus on responsible investing and long-term value creation.

Over the past year, we’ve continued to embed sustainability into everything we do, whether that’s through our portfolio-wide ESG action plans or the delivery of our first ever Impact Report at the end of last year. It’s fantastic to see this progress recognised in such a competitive category, and a testament to the hard work of our team and the ambitious management teams we partner with.

You can view the full shortlist here.

News

14/07/2025

ECI shortlisted for PE House of the Year at Sustainable Investment Awards

Isa Maidan recently attended the Phocuswright Conference 2025, where industry leaders and innovators gathered to discuss the future of travel. Unsurprisingly, AI was front of mind, almost all panels and presentations eventually found their way to our algorithmic friends. There was a lot of talk about what artificial intelligence could do, but what are customers doing today, what is coming imminently and what does the future look like?

What is being used today?

More and more customers are using AI to plan their holidays, using it to narrow destination options and plan broad itineraries for a trip. Whilst there isn’t data available on it, there was an agreement that LLMs are clearly part of younger customer decision making around travel. For many businesses, this represents an element of their customers’ journey that isn’t very well understood.

An interesting point to note, when people in the room were asked whether or not they had used AI to research holidays, most hands went up. When asked if they had actually booked the generated suggestion, most went back down. It’s important to take a pragmatic view that as of today, it hasn’t yet dramatically changed the booking process. However, for simpler bookings, the direction of travel is absolutely clear over the longer term.

What is imminent

The big one here: search.

The combination of a highly competitive market and customers’ strong purchase intent at the time of search has meant the travel industry has become highly reliant on PPC. As an investor, a key part of DD for many travel businesses in the last 10 years has been understanding their PPC capabilities and the sustainability of driving traffic through google. This is changing.

AI summaries are leading to fewer clicks and a shift away from Google into LLMs, which is understandably a concern for those who have optimised marketing for Google PPC. Going slightly further down the track, the recent trial and launch of Google AI mode (where search shows very few / no links) has led a lot of people to question what their future marketing spend looks like. More specifically, how do you optimise for a hyper personalised search into an algorithm that you don’t yet understand?

What is evident, is there is a significant opportunity here. Travel websites are complex, so it isn’t easy to transform a site to be optimised for GEO, but those that are agile and able to do so now will see the upside. Search disruption is also not necessarily a bad thing. A single engine dominating traffic has meant CAC often represents a significant portion of many travel businesses’ cost base. Given the general view is LLMs are likely to move to ads, a bit of competition in the search world is no bad thing.

Future

Agentic AI is the clear answer here, the idea being AI can search for, plan and book your perfect holiday based on your historical preferences and specific wants.

This raises significant questions and opportunities for a lot of travel businesses today. What does your business look like if at the extreme we move from a multi- step process today – (plan, search, browse, refine, transact) multiple times across the travel journey, to plan, review, book?

A further consideration that came up multiple times was the interplay between tech and trust. Historically customers have wanted solutions that tech wasn’t capable of delivering. Increasingly with AI it is looking like tech will be delivering solutions before customers trust it. With that in mind, rushing out a sub-optimal solution is not the answer here. Being a brand that is trusted and taking customers on that (improved) journey will be hugely important.

Whilst it’s currently unclear who the ultimate winners and losers are, what is clear is that there will be disruption and therefore opportunity ahead. As an investor, there is renewed focus on travel companies that are offering something that AI can’t easily compete with – high touch, personal, bespoke service and complex travel, where the trust threshold is high. If that isn’t your business model, it’s time to get on the front foot re AI.

If you would like to find out more about how we are helping travel brands grow, please get in touch.

Insights

10/07/2025

Isa Maidan

Read Time: Min

AI travel – today, tomorrow, the future

Stephen Roberts recently attended the CIPD Festival of Work which brought together nearly 13,000 professionals across HR, L&D, and leadership to explore the future of work. Stephen shares his key insights on how leaders in the HR sector are adapting to a rapidly changing landscape.

1. Engagement: your people are your customers

According to ADP’s 2024 global study, only 21% of employees are fully engaged at work. That means nearly 80% are not. Yet engagement is the single biggest driver of productivity and loyalty.

As Annabel Jones of ADP put it, HR teams need to think like account managers. Every employee is subscribing to your workplace - and they can churn if the experience doesn’t deliver. That means understanding what matters to each individual, in the context of their team and the wider organisation.

Quarterly pulse surveys are replacing outdated annual engagement reports, and HR software like Ciphr can help HR teams monitor engagement in real time and identify where to improve.

But surveys help you assess engagement, not deliver it. That comes down fundamentally to pay, progression, and purpose. If people can’t see a future in your organisation, they’ll find one elsewhere.

2. Investment skills: build a workforce that stays

According to ADP, only 17% of UK employees believe their employer invests in the skills they need to advance. That figure drops to 12% across Europe. Yet when employers do invest in training, workers are six times more likely to recommend them.

The most in-demand areas? Communication, leadership, and soft skills. These aren’t just “nice to have”- they’re essential for navigating change, managing teams, and driving performance.

There has been a growth in companies that are helping businesses build scalable training pipelines. But the real shift is cultural: from seeing training as a cost, to recognising it as a strategic investment in retention and growth.

3. AI adoption is a people challenge as well as a technical one

“AI won’t take your job - but people who use AI will.”

AI is a source of worry for many employees, while younger employees are more optimistic, many see it as a threat. The solution? Involve your people in how AI is introduced and used. Done right, AI should reduce stress, not to add to it, but people need to have clarity on why it isn’t a threat but a facilitator.

As Neil Pickering of UKG noted, AI adoption starts with understanding your own data and processes. Then it’s about removing friction - making AI easy to use, secure, and clearly beneficial.

At ECI, this is an area we actively support management teams with, identifying and facilitating the most valuable use cases for AI, in a way that can make their teams more productive, and engaged through spending their time on higher value tasks.

4. Trust and transparency over surveillance

Speakers noted that monitoring tools are on the rise, but they’re not always delivering the results leaders hope for. In fact, employees who feel watched are four times more likely to report low productivity.

The answer isn’t more surveillance - it’s clarity in communications. When people understand what’s expected of them, they perform better and feel less stressed.

OKRs or V2MOM are frameworks used throughout our portfolio to align teams around shared goals. But the real shift is mindset: trust your people to deliver, and they usually will.

As one speaker put it: “Are we using productivity tools to build a better business - or because we don’t trust our people?”

5. Boost the wellbeing of your team

In 2023/24, the UK lost an estimated 16.4 million working days to stress, depression, or anxiety. Burnout is a productivity killer and it’s often preventable.

Creating a culture where people feel safe, supported, and included isn’t just good ethics - it’s good business. That means normalising mental health conversations, training managers to spot the signs, and designing work in a way that supports balance.

Flexible working helps but only if it’s backed by trust and fairness. Nearly 30% of employees say they feel judged for using flexible policies. That needs to change.

If you’d like to chat to anyone about how we are working with HR Tech companies, and supporting companies to enhance their people and culture strategies, please get in touch.

Insights

03/07/2025

Stephen Roberts

Read Time: Min

How HR tech is boosting engagement

Despite the significant challenges posed by US tariffs, does the recent executive order signed by President Trump on US-UK trade create any opportunities for UK companies?

While we are in an era where anything can change any moment, Lewis Bantin looks at the current state of the market, and where there may be some opportunities for those in the UK.

1. Potential for increased competitiveness for UK exports

While the UK faces a 10% baseline tariff on most goods exported to the US, this rate is notably lower than the reciprocal tariffs imposed on many of the UK’s key competitors.

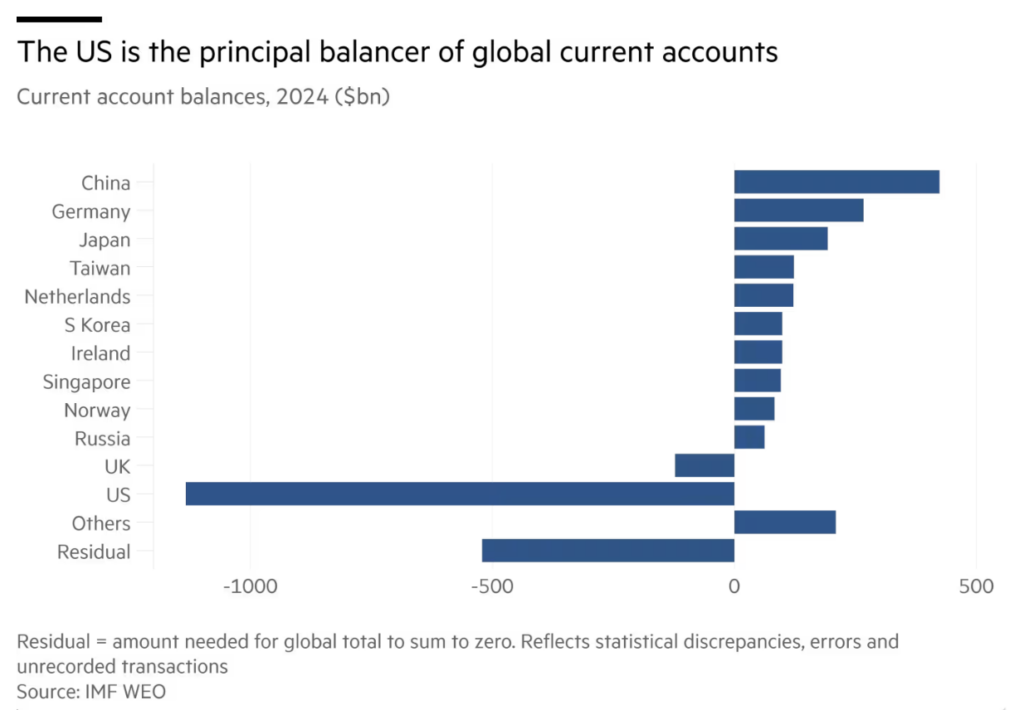

Given the state of the global current account (im)balance (see IMF analysis below), Trump has hit Europe with a 50% tariff on steel and aluminium and a 25% levy on cars; the EU is trying to secure a deal before July 9, when reciprocal tariffs on most other goods would rise from 10% to up to 50%. For China, US tariffs will be set at 55%.

Depending on the final rate of reciprocal tariffs, the differential could make UK exports to the US comparatively cheaper, creating a ‘least bad option’ advantage. Similarly, with the EU looking at a minimum of 10% reciprocal tariffs on the US, EU buyers of software may look to the UK for service given the immediate price advantage, but also, and perhaps more importantly, greater predictability about future cost. In the meantime, you may also see a benefit for companies, such as Moneypenny, that are operating across both regions with a US and an UK HQ.

2. Opportunities arising from new US-UK trade deals focusing on digital trade

The recent UK-US Economic Prosperity Deal, announced on May 8, 2025, represents a significant development. While it did not fully resolve the Digital Services Tax issue, it explicitly establishes a foundation for a deeper relationship with a strong focus on technology. This agreement includes a platform for future negotiations on digital trade, critical minerals, and economic security.

The stated objective is to “strip back paperwork for British firms trying to export to the US”, with the potential to open a vast (US) market and significantly boost the UK economy. This suggests avenues for deeper collaboration in areas such as AI and quantum technologies. The explicit emphasis on a “digital trade deal” and “technology partnership” signals a clear recognition by both governments of the growing importance of the digital economy. This is good news for UK software companies, especially if it leads to a more streamlined regulatory environment, allowing them to access more of the global market. This will especially benefit those that have shifted away from hardware, for example Peoplesafe have shifted from hardware to cloud-based application, which has seen a 158% growth in app sale requirements compared with 30% for devices since 2022.

3. The drive for accelerated AI adoption and operational efficiencies

The cost pressures, supply chain disruptions, and market restrictions imposed by tariffs are compelling businesses across various sectors to seek greater cost efficiencies and re-engineer their processes. This environment creates a strong incentive for the accelerated adoption of AI to improve both the productivity of internal process as well as open new use cases for services.

With a wealth of UK and European software companies specialising in these areas, there is an opportunity to sell to those looking to mitigate tariff impacts through digital transformation and the outsourcing of “non-core” services to niche expert providers.

4. Supply chain shifts

Tariffs can induce sudden shifts in global demand and supply patterns, leading businesses to actively move away from exposure to “tariff-heavy” regions of the world. This dynamic could present opportunities for UK-based companies to benefit from a higher supply of, and potentially cheaper prices for, tech goods and components that were previously destined for the US. This also generates new demand for software solutions that assist businesses in managing increasingly complex and diversified global supply chains.

There is a chance that we may see more foreign investment in the UK tech sector as companies in other locations with higher tariff rates look to relocate to take advantage of the comparably lower rates in the UK – assuming, of course, that the “new normal” of global tariffs persists. However, this will all come out in the wash in the medium to long-term, depending on the rates imposed, and whether they stick.

No one wants to operate in a protectionist world; it limits global trade and hinders predictability, which is damaging to business and investment decisions.

However, despite this complex and dynamic environment, the UK is relatively well placed and recognises its need to trade in an agile way. UK companies should be on the lookout for opportunities coming out of this wider climate.

Insights

30/06/2025

What opportunities will global tariffs create for UK companies?