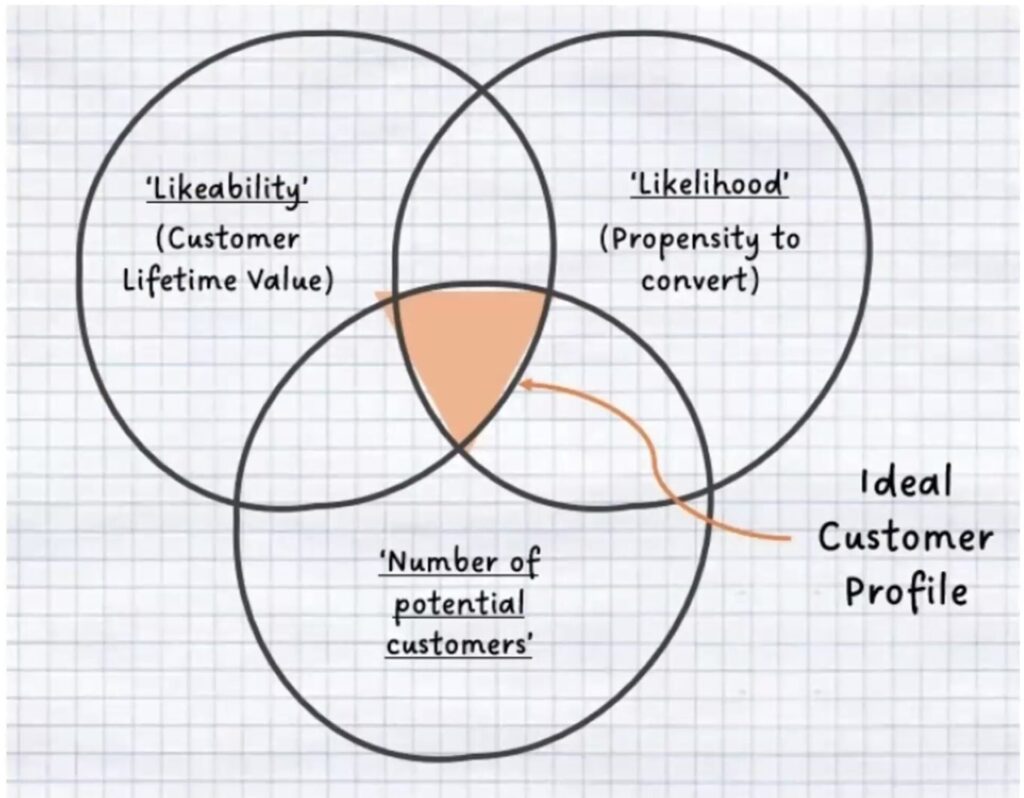

In a recent webinar we hosted as part of our ECI Unlocked series, where we bring together our portfolio leaders to discuss shared challenges and opportunities, we looked into one pillar of growth: the Ideal Customer Profile (ICP).

Hosted by our Commercial Team Partner, Lewis Bantin, we were joined by Dave Kirby, CEO & Founder of Coppett Hill Growth Advisory, and Jon Stead, CRO of ECI portfolio company CMap.

We've distilled the key takeaways on why defining and developing your ICP isn't just a nice-to-have – it’s imperative for growth.

What exactly is an ICP?

Let's start with the basics. Dave Kirby defines it as, "An ideal customer profile is a description of the customers that you'd most like to acquire for your business." It goes beyond simple demographics and delves into the specific characteristics, needs, and challenges of the customers who will derive the most value from your offerings and, in turn, be the most valuable to your business.

Getting your ICP right isn't just about ticking boxes; it's about creating harmony within your organisation. When you have a clear understanding of your ideal customer, Dave explains "The business should feel simpler... Like musicians in tune with each other, there’s clarity and simplicity." This alignment permeates every aspect of your operations, from sales and marketing to product development and customer success.

Conversely, lacking a defined ICP can lead to challenges. Without a clear target, Dave flags "you’ll see sellers ploughing their own furrow, high variability in customer profitability, and difficulty forecasting growth." Resources are spread thin, efforts are diluted, and achieving consistent, predictable results becomes an uphill battle.

Why ICPs matter: the tangible benefits

Investing time and effort in developing a robust ICP yields significant returns:

- Laser-focused efforts: Dave illustrates, "It allows us to customise our product and service, tailor our messaging, and know exactly where and how to find our customers."

- Improved efficiency and ROI: A great ICP leads to higher conversion, shorter sales cycles, better retention, and ultimately, stronger profitability.

- The power of narrowing focus: CRO of CMap, Jon Stead, explains "Once we narrowed down our sectors, that’s when everything clicked. Doing less, but better, has led to our success." Resisting the urge to be everything to everyone can unlock significant growth.

- Strategic reprioritisation: Jon continues, "We aligned the business around just two sectors, two geographies, and a size range, and our team finally had brain space. That laser focus changed everything." Committing to your ICP may require making tough decisions about where to invest your resources.

- Cultivating internal alignment: Jon shared, "Internal culture shifted: The sense of ownership in their sectors changed how we worked together." ICP-based teams can foster a stronger sense of ownership and expertise.

How to define your ICP: A practical approach

- Start with key dimensions: We think about our world principally through three dimensions: sector, size, and geography. These are often foundational elements for B2B ICPs.

- Ensure prospectability: Your ICP dimensions should be prospectable. If you can’t find data on a trait, it shouldn’t be part of your ICP. Focus on attributes that are measurable and accessible through market research, databases, and other data sources

- Tailor your go-to-market strategies: Your ICP is only as good as your ability to engage with it. Different ICPs require different outreach and engagement strategies.

- Align operations with ICPs: Structuring your teams and processes around your ideal customer segments ensures targeted and effective engagement.

- Iteration is key: Your initial ICP might focus on certain targets. However, as you engage with the market, you might discover unmet needs or features that make you adjust your ICP. Iterating allows you to fine-tune your understanding of what truly drives your ideal customers.

Smart targeting with AI: The future of ICP engagement

Tools powered by AI have changed the way ICPs can be identified and targeted. Sophisticated AI tools now autonomously analyse company websites, intelligently categorising them into precise ICP segments. This automation dramatically reduces the resource burden on your team, freeing up valuable time:

- Precision targeting with automated account scoring: Allowing for a more precise approach to the most promising leads.

- Data analysis & insights: Uncover valuable patterns and insights from in-depth data analysis, allowing for highly personalised messaging and a deeper understanding of your target audience.

Key learnings: essential takeaways for having a successful ICP

- The discipline of saying no: Resisting the temptation to chase every opportunity is critical for maintaining focus.

- Effectiveness before efficiency: Initial experimentation and iteration are necessary to refine your ICP and go-to-market strategies.

- Tailoring your approach: Recognise that different ideal customer profiles will require different go-to-market strategies. What works for one segment may not work for another.

Developing a well-defined Ideal Customer Profile is not a one-time exercise but an ongoing strategic process. By understanding who your best customers are, where to find them, and how to best serve them, you can unlock significant efficiencies, drive sustainable growth, and build a more resilient and focused business.

Please reach out to Lewis Bantin in our Commercial Team if you would like to discuss this more, or if you would like to see a copy of the recording.

Insights

24/04/2025

Lewis Bantin

Read Time: Min

Why developing your Ideal Customer Profile is crucial for growth

During our investment in the leading provider of SaaS safeguarding software to schools, CPOMS, the ECI Commercial Team helped them launch new products, create a predictive model to drive sales and deliver a North American internationalisation strategy.

Following on from our investment in 2018, the company experienced significant organic growth, increasing its client base from 6,000 schools to more than 14,000, and significantly increased its international presence, selling to 34 countries.

Here are some key areas of growth over the course of our investment:

Internationalisation

One of the most critical factors in CPOMS growth story was the expansion into US markets. Recognising the potential for growth, the ECI Commercial Team helped develop an internationalisation strategy, led by our North American Growth Specialist, Brett Pentz.

Brett assisted in creating a go-to-market strategy specifically for Canada and the USA. This hands-on support in navigating new markets was instrumental in CPOMS expanding its reach from serving schools in just four countries outside the UK to 34 countries by the time of ECI's exit.

Product innovation and development

Product expansion was one of the key ways in which ECI supported CPOMS. We helped the management team with a customer engagement project through which CPOMS assessed demand for products that complemented its core child safeguarding and wellbeing software. This led to the launch of two additional products: CPOMS StaffSafe, which aims to strengthen governance relating to members of staff, and the CPOMS Engage module, which aids alignment and communication between schools and local authorities.

Leveraging technology and data analytics

Beyond the predictive sales model, ECI supported CPOMS in investing in the underlying technology platform and operational processes to ensure scalability and efficiency. This commitment to technological advancement was a key factor in CPOMS receiving the prestigious Queen's Award for Enterprise in 2020, as well as winning the PEI Operational Excellence award in 2022.

In October 2021, CPOMS was successfully realised to private equity-backed US school safety software provider Raptor Technologies.

Insights

14/04/2025

Read Time: Min

Global growth story for safeguarding solutions provider, CPOMS

We're delighted to announce that Neal Griffith has joined ECI as CFO designate.

Neal joins from pan-European private equity firm, Equistone Partners Europe, where he was CFO and Chief Risk Officer, having joined as Group Financial Controller in 2017. Prior to Equistone he was Fund Financial Controller for investment firm, BC Partners. His appointment to CFO will follow the retirement of incumbent, Philip Shuttleworth, at the end of the year, after almost 30 years with ECI.

News

14/04/2025

Read Time: 1 Min

ECI appoints Neal Griffith as CFO designate

The pharmaceutical industry is evolving rapidly. Increasing regulatory requirements, market fluctuations, and technological advancements are making it more challenging for companies to manage everything in-house. As a result, many firms are turning to outsourcing to remain efficient, compliant, and competitive.

After some of our team attended the 2025 EPA Conference in Amsterdam, Europe's largest conference for market access, pricing and evidence, George Moss and Sarthak Sawlani look at five key trends - from new EU health regulations to AI-driven innovation – driving increased outsourcing in pharma today:

1. The impact of EU HTA

The new EU Health Technology Assessment (HTA) regulation, passed in 2021 and coming into effect from this year, is set to transform how pharmaceutical companies bring new treatments to market across Europe. While it standardises assessment processes, it brings with it new compliance challenges. Under the new framework, companies must submit HTAs within a strict 90-day deadline, while also comparing treatments across multiple EU countries and managing large volumes of clinical data.

To manage this, many pharma companies are outsourcing rather than building these capabilities in-house. Regulatory consultancies can provide guidance on submissions, helping to reduce potential delays or rejection. Market access specialists can support pricing negotiations and reimbursement strategies, making it easier to enter different European markets. Meanwhile, health economics and outcomes research (HEOR) experts can assess cost-effectiveness, helping companies prove the value of their treatments to regulators and payers.

At the 2025 EPA Conference, it was highlighted that global drug spending has stayed at a steady percentage of total healthcare costs for the past decade, however pricing is coming under increased pressure and scrutiny. It raised the importance of communicating the value of new treatments and using the best technology and advice to position them in the market so as to succeed.

2. Policy shifts and Inflation Reduction Act in the US

The US remains the largest pharmaceutical market in the world, but ongoing policy changes and pricing pressures are creating a more unpredictable environment for drug manufacturers. The Inflation Reduction Act (IRA) has introduced new Medicare price negotiations, and with the possibility of further changes under Trump, pharma companies need to rethink their pricing strategies and market access plans to stay competitive. One of the biggest challenges is the new Medicare price negotiation process for high-cost drugs. This could have a major impact on how companies set their prices and generate revenue.

Whilst pharmaceuticals products were initially exempted from the first tariff announcement, uncertainty remains whether specific pharmaceutical tariffs will be targeted in short order, and there clearly is now significant uncertainty across all sectors for global supply chains off the back of last week’s US tariff announcements.

With so much unpredictability, many businesses are turning to specialist expertise to help them navigate these changes. By outsourcing to regulatory and market access specialists, pharma companies can ensure they stay ahead of evolving FDA requirements, keep development pipelines focused and drug approvals on track.

3. The rise of AI & Technology in pharma services

Many pharma companies have access to huge volumes of data, opening up AI transformation possibilities, from drug development to commercialisation. The challenge is using the data effectively - most lack the in-house expertise making it difficult to fully unlock AI’s potential.

At the 2025 EPA Conference, AI was a key topic, with discussions on how it’s shaping pricing strategies, payer sentiment analysis and regulatory decision-making. The benefits of HTA sentiment analysis were highlighted as well as the opportunity to use AI to assess payer perceptions to help predict launch prices. Wayne Speechly, CEO of Global Pricing Innovations, emphasised that AI’s effectiveness depends on the quality of its datasets, noting that LLMs (large language models) can be affected by bias which is why GPI runs multiple models that can learn from one another.

Despite its advantages, integrating AI into regulatory and commercial workflows remains complex, as they must meet strict FDA and EMA regulations. Pharma companies are taking very different stances on this, with some embracing AI and progressing trial deployments of it internally, while others are taking a much more cautious approach. Clearly, AI can speed up compliance, improve drug pricing strategies, and help design more efficient clinical trials. However, these benefits come with significant regulatory requirements. This is why technology-focussed outsourcing partners are playing an increasingly important role, enabling pharma companies to leverage AI’s full potential without the cost and complexity of building their own tools in-house.

4. Real world data in clinical trials

For a while, regulators and payers have been looking beyond traditional clinical trials and asking for real-world evidence (RWE) to assess how well a drug works in everyday life. While clinical trials provide data from controlled settings before approval, RWE comes from real patient experiences, using data from patient registries, insurance claims and electronic health records both during and after trials.

Managing this large volume of data while ensuring accuracy and compliance can be a significant challenge, but significant leaps forward in technology and AI in particular are now starting to really unlock the potential here and deliver insights into how a particular drug or therapy performs in a patient population. This will ultimately result in better patient outcomes.

5. M&A in pharma outsourcing

The pharma outsourcing industry is experiencing significant consolidation, with larger firms acquiring specialised providers to offer their customers full-service solutions. This means that instead of working with multiple vendors, customers can now partner with a single outsourcing partner that can offer services and technology across multiple areas from clinical trials delivery to addressing commercialisation and regulatory considerations. With increased costs on businesses through tarriffs, there are also strong drivers for providers to sell in the current market.

This trend is making outsourcing more accessible, mission-critical and efficient. As the industry grows and professionalises, pharma companies can more easily find partners with both the scale and expertise they need, helping them navigate everything from regulatory approvals to market entry without building these capabilities in-house.

If you would like to chat to ECI about how we can help your pharma services business – please get in touch with george.moss@ecipartners.com or sarthak.sawlani@ecipartners.com

Insights

07/04/2025

Sarthak Sawlani,

George Moss

Read Time: Min

What’s driving pharma outsourcing in 2025 and beyond?

Each month, we turn the spotlight on the leadership teams in our portfolio to find out what drives them, who inspires them, and the biggest lessons they’ve learned.

This month, we chat with John-Paul Savant, CEO of Auction Technology Group (ATG), a global leader in online marketplaces and auction technology. Since joining ATG in 2016, John-Paul has led the business through a period of significant transformation, growing its impact on the circular economy while scaling operations to facilitate over $13 billion in annual sales.

John-Paul shares what motivates him, his thoughts on leadership, and the one rule he expects his employees to live by.

Q: Which one rule do you expect your employees to abide by?

Be honest. Whether it be within my exec team or within our overall team of 600, I want people to tell it as it is and to give me the reality. I’m not saying I take what everyone says without challenging whether their truth is THE truth, but I want people to tell their truth. Without that, it leads to a cascade of other issues, not the least of which can often be a cascade of bad decisions. Colleagues, the management team, and the Board cannot make good decisions unless what they hear is truth, so yes, my one rule is Be Honest.

Q: What motivates you?

Seeing the full picture of what I envision become a reality. I’m a fairly intuitive person and I love seeing potential in things that others may overlook whether it be people, buildings, objects, or whatever. But when I see the potential in something, often a whole picture of “what can be” emerges in my mind at a gut level that feels right, and then I start looking for data, people, and other elements that can help me make it become reality. But the motivation is building something that encompasses the fullness of what I envisage and turning it into a reality.

Q: What are you most proud of in your career?

I would have to say it’s what we’ve achieved at ATG over the last 8+ years as it’s been a financial success but also is doing something good for society as we are massively accelerating the circular economy. In 2016, when ECI hired me, we facilitated the sale of just over $1 billion, had ~$20m of revenue and $3m of profit and I think ATG was valued at about $30m.

Today, we facilitate the sale of over $13 billion, we have $180m+ of revenue with over $80m of EBITDA and is valued at ~$850m. So we make a bigger impact on the environment and are more successful financially. I feel more proud of what we've done at ATG than having been part of the team at PayPal that built PayPal Europe from $0 revenue to $1.8 billion over 10 years.

At PayPal you always wondered if it was really YOU making the difference. And if you have any humility at all you realise that maybe you made a bit of a difference but that it was a great idea at the right time and you were lucky to be part of the journey. But with ATG, I think the staff and the management team and I, especially Tom Hargreaves, Richard Lewis and Badr Khan in the early days and now my current exec team of Meghan Nally, Jeremy Stewart, Darren Ali, and Richard Lewis (still!) are the ones who can truly say we’ve led this transformation and made a difference.

Q: Who do you admire / who inspires you?

My father. He was a true Renaissance Man in that he loved and was capable at everything - great sportsman, lauded university professor, published poet, excellent musician, great public speaker, and also great with building things with his hands, as he basically built half our home as we grew up.

He was also a great grandfather - lying on the ground with my kids for 4 or 5 hours at a time. But above all, what I respected was that he always saw the best in people and people knew that and were drawn to him. He focused on what he saw that was good in people versus what he didn’t like. He was authentic. What you saw on the outside was how he behaved at home as well. He used to say he was a French peasant at heart because of his love of manual labour and working with his hands, but I always saw him as someone who had natural nobility in him.

Q: What do you think makes a good leader?

I think to be a leader requires passion and belief in what you are doing. As leading by definition means you’re taking others in a direction. And you don’t get paid to lead because it’s easy. So you have to have belief and passion to give you the energy to see you through the hard times, the times when things are not clear on what to do next, the ability to give others faith that you can reach where you’re heading, even if there’s doubt and doubters around you.

Strategy, hiring well, prioritising, the ability to sell your idea, and setting up solid processes are all important but if you don’t have that next level of belief, I don’t know if you’ll be able to lead through the hard times or when things don’t go to plan. When you have it, it’s what sustains you and also helps you remain focused on doing what’s right for the company regardless of short-term obstacles.

Q: How has leading a publicly listed company changed the way you approach leadership?

Since ATG went public in 2021, I think what’s changed most for me in how I lead is really two things:

1) Seeing truly the importance of hiring far ahead of the curve at the exec level to get the talent I need for the next level of aspiration for ATG. One great exec in a key role makes a huge difference and they are worth the money.

2) Needing to learn how to bring a public Board along my thought journey and how to better support the education process by sharing the right information and thinking further ahead on key questions.

I’ve worked with many good board members but I’ve learned the most from our Chairman, Scott Forbes, about seeing how all elements of running a public company - from Remco, Nomco, Auditco, ESG, Board meetings, Trading Statements, to Earnings Calls - can be run and organised and what you can achieve with each to the benefit of the company.

Q: How do you switch off from work?

Lots of things help me switch off. Primarily time with my kids as each of the 4 of them want and need different things and I enjoy the variety of it. But when it’s purely for me, it’s probably thinking about our home I am restoring in the Savoie region of France where my family is from or talking about it with my eldest son or younger ones. And, closer to home in London, I enjoy gardening and hiking or any National Trust property with the family.

Q: What item do you own that you would you never put up for auction (no matter the price!)?

Our family home in France. Someone could offer me 20x the actual value of it and I’d not sell it because it means too much to all of us. Closer to home, probably the plaster imprints of the kids feet from when they were babies.

Q: Favourite film?

Lots of good films. I can't really choose. But something I can watch over and over again? Probably any of the Super Bowls of the 49ers where Joe Montana was quarterback.

Insights

03/04/2025

Read Time: Min

“In Focus” with ATG CEO, John-Paul Savant

This April is stress awareness month, and those in high-pressure industries (such as those working in private equity or PE-backed companies!) know that stress is often unavoidable. To some extent, having responsibility and working with high-calibre individuals in a fast-paced environment is part of what makes the job so exciting. But stress should not be a constant factor in your work, and it needs to be managed to make sure your mental health and job satisfaction are not negatively impacted. We have pulled together 7 simple ways to help combat stress, no matter where you work:

1. Communication culture

Acknowledge stress and don’t try to hide it. Not only will this help lighten the emotional burden and promote healthier coping mechanisms, but it also makes other people feel less inclined to bottle it up, so it has an amplifier effect across your organisation. Your network should also provide support and a safe space to vent. Connecting with mentors who understand your position can help reframe challenges through sharing lessons learned.

2. Recognise the signs of burnout

Prevent stress from turning into burnout by recognising when your stress levels have become unmanageable. This might be physical symptoms such as sleep problems, emotional symptoms such as irritability or depression, or behavioural symptoms such as a negative mindset and feeling worthless at work. Spotting these early means that you can intervene and get help or face the root cause rather than letting it spiral.

3. Time away from Teams/Zoom

Everyone needs time away from work or thinking about work, but in today’s always-on tech, it can be easy to feel like the work never stops. Create space for time where you aren’t one notification away from being pulled back into thinking about the next task on your plate.

4. Understand when stress is advantageous

Stress can reflect that we’re invested in something we think is important. It can make us work harder, dedicate more of our time and think creatively. Understanding when it is beneficial and using it appropriately can be a superpower. Just as stand-up comedians try to imagine that the nerves they feel before going on stage are in fact excitement, try and understand whether some moments of stress can be reframed as reflecting your enthusiasm.

5. Realistic and clear priorities

An unrealistic to-do list will make anyone stressed. Avoid being overwhelmed by understanding which tasks you need to do – if possible, use the Eisenhower Matrix to prioritise by urgency and importance. Set realistic deadlines and communicate them clearly. Block out time for focussed work and don’t be afraid to say no to meetings that take up space needed for thinking and doing. Remember, you control your time.

6. Avoid superhero syndrome

Leaders are often under immense pressure to make critical decisions, but feeling you must handle everything yourself will only lead to isolation and feeling overwhelmed. Instead of trying to save the day, empower your team to make decisions with your support. Not only will this promote leadership across your organisation, but it will also bring in a broader range of perspectives and more job satisfaction for those who feel trusted to do their job.

7. Celebrate successes

Working in fast-paced jobs means that expectations are incredibly high. Which may mean it feels like every milestone is par for the course, and you end up in a high-stress and low appreciation cycle. Instead, take time to celebrate work goals, projects finished, deals done, etc. Not only will it give you greater job satisfaction, but it will also help the whole team recognise that hard work is valued.

Insights

01/04/2025

Read Time: Min

7 ways to combat stress in high pressure industries

The UK's leading provider of professional pensions trusteeship and governance services, Independent Governance Group (IGG), today announces several new senior level appointments.

Mike Kirby assumes the role of Non-Executive Chair, having previously worked with ECI as CEO of KB Associates. Mike will work closely with Andrew Bradshaw and the Executive Team to oversee IGG’s strategic direction and ensure that the Group continues to evolve its offering. With over three decades’ experience in asset management and financial services, Mike brings deep expertise in governance, compliance and risk management to IGG.

Chantel Garfield will join IGG as CFO, with an extensive background in financial operations. Prior to this, Chantel served as Group CFO for several years at Charles Taylor, a claims and technology solutions provider to the global insurance market. In addition, Chantel spent a decade at LexisNexis, a global provider of legal, regulatory and business information, ultimately as Head of Financial Planning & Analysis (FP&A).

News

28/03/2025

Read Time: Min

IGG welcomes new Non-Executive Chair and CFO for next phase of growth

What was front of mind for CEOs and HR leaders at the HR Tech Europe Conference in Amsterdam? Isabella Fox who attended the March event shares her key insights from the conference:

It is clear that AI remains the ultimate buzzword in European HR tech. However, the landscape has evolved, with AI now part of a continuous transformation as opposed to the single catalyst it was considered to be a few years ago. The impact on the sector is beyond doubt – it is the pace of change which is being debated.

Speakers from the likes of Coca-Cola and Volvo, or Mercer and Deloitte, all shared similar views on some key trends permeating the sector:

1. Human-centric AI

Investment in AI continues, although it has transitioned from being perceived as innovative to now being an enabler. The reality of AI being utilised effectively by HR teams, however, remains behind the curve. Whether it is organisational structure or data, most businesses don’t have sufficiently stable foundations to maximise AI’s efficiency, resulting in the risk that AI is layered into businesses without improving productivity. Many businesses are still spending a lot of time fixing interfaces or grappling with data.

This provides an opportunity for tech/AI providers who can create human centric solutions. Clearly even digitally advanced firms are still doing a lot of HR activity in very manual ways – i.e. recruitment, despite it being one of the first areas to adopt AI solutions. The solution in today’s environment can’t just be whether the tool is innovative, it is whether it is easy to adopt by the end users.

2. The importance of the right Tech Stack

The HR tech stack is vast. In an ideal world, a core HR Information system would be integrated across some key areas:

- Talent acquisition and recruitment

- Performance management and employee development

- Learning and development

- Employee engagement and wellbeing

- Payroll and benefits

- Analytics and reporting

- Collaboration and communication tools

However, usually an HR tech stack evolves in a slightly less ordered way as point solutions are needed, which means they aren’t always fully integrated. As businesses grow, they need to assess whether their HRIS is sufficient for them. There is an efficiency and usability experience factor for both employers and employees that is causing change in the sector, as HR teams focus on streamlining systems. This in turn is driving better employee experience, improved compliance, and data driven decision making.

3. The resilience of HR teams

As we discussed last week in our look back on the 5 years since the pandemic, the period since 2020 has been tumultuous for HR teams. The shift to remote working as well as a wave of job changes have kept teams incredibly busy.

The pace of change for HR teams doesn’t look set to slow down. There is still a lot of uncertainty in the market and with the advent of AI there has been additional complexity to consider. Overall, the consensus at the conference was that these teams have had to show remarkable resilience in recent years. The future is bright with AI providing the promise of a reduction in manual tasks, but this is not immediately on the horizon for most teams.

4. Employee wellbeing is still a top priority

Wellbeing remains a key focus for those in HR across all job roles, with the likes of Coca Cola having wellness rooms across its factories. For HR Tech platforms, modules such as employee engagement and wellbeing are becoming increasingly important for an HRIS to accommodate.

The first step to enhancing wellbeing is tracking it with monitoring, with HR platforms providing new and easy ways to understand employee sentiment. That increased monitoring inevitably has led to more demand for levers to pull to improve engagement. Changing regulation/labour laws is also a driver in some industries, but for the most part it is employee expectations that continue to grow, and HR tech is responding to that need.

We’ve seen this ourselves at portfolio company, Ciphr, who acquired Avantus at the end of last year, giving HR teams the ability to pick the right mix of employee benefits that resonate with their people, including health and wellness schemes, lifestyle rewards, discounts and savings and more.

Insights

27/03/2025

Isabella Fox,

Stephen Roberts

Read Time: Min

What is front of mind for the HR Tech sector in Europe?